Digital Receipts that

actually work for

Card Issuers

Stop friendly fraud before it starts. Deliver itemized receipts directly to banking apps, so customers see exactly what they bought.

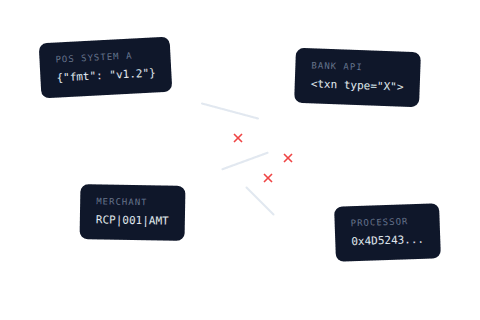

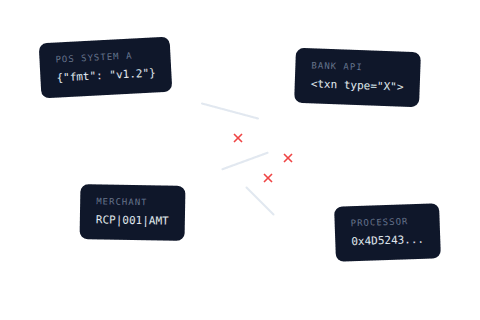

The Problem

Why don't digital receipts exist already?

Here's what's been holding the industry back—and how Vero solves it.

Every POS system, bank, and merchant uses different data formats. There's no common language.

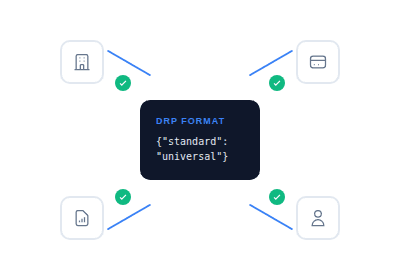

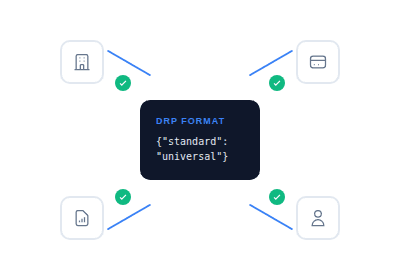

The Solution

How Vero changes everything

We built the infrastructure the industry has been waiting for.

The Digital Receipt Protocol creates a universal format that works across all systems.

Replace cryptic codes with clear receipts

Customers dispute transactions they don't recognize. Vero delivers itemized receipts directly to banking apps, so customers see exactly what they bought instead of cryptic merchant codes.

Customers recognize transactions

When customers see itemized details instead of cryptic codes, they stop disputing purchases.

Instant delivery to banking apps

Receipts arrive in real-time directly in your customers' banking apps.

Stop friendly fraud

Legitimate purchases disputed by mistake cost billions annually. Vero prevents them.

Payment Complete

import { Vero } from '@vero/sdk';

// Initialize Vero with your API key

const vero = new Vero({ apiKey: process.env.VERO_API_KEY });

// Register a user's card for digital receipts

const { publicKey } = await vero.keys.generate();

await vero.users.register({

hashedPan: hashCardNumber(cardNumber),

publicKey,

});

// That's it! Receipts will now be delivered automatically.For Developers

Integrate in minutes,

not months

Our SDK handles the complexity of key management and encryption. Card issuers can enable digital receipts for their users with just a few lines of code.

Integration

Built for everyone in the ecosystem

Give cardholders transaction clarity while cutting dispute costs

Your banking app retrieves itemized receipts via our API. Customers see what they bought instead of cryptic merchant codes. Disputes drop because customers recognize their purchases.

- Reduce friendly fraud

- Lower call center volume

- Better digital banking experience

- Competitive differentiation

Security

End-to-end encryption by design

Digital receipts require privacy. Card issuers deliver but cannot read your receipts. Built on the open Digital Receipt Protocol (DRP).

Only you and the merchant know what was purchased.

Encrypted at the source

Receipt data is encrypted on the merchant's POS before it ever leaves the store.

Card issuers can't read it

They deliver the receipt but cannot decrypt it. Zero-knowledge architecture.

You hold the keys

Only you can decrypt your receipts. Share with expense tools or keep private.

Become a Pilot Partner

We're working with early partners to prove Vero in production. Shape the product as a founding partner.